Financial emergencies can happen anytime, but getting money quickly is now easy. With digital personal loan apps in India, you can apply for instant loans using your smartphone. There’s no paperwork, no waiting, and no bank visits just quick approval and fast disbursal directly to your account. These apps are designed for today’s lifestyle, helping users handle expenses like rent, education, medical needs, or travel. They ensure a safe, simple, and quick loan process. This blog will help you discover the Top 20 Best Loan Apps in India and also guide you on how to create your own loan app if you’re planning to enter the fintech market.

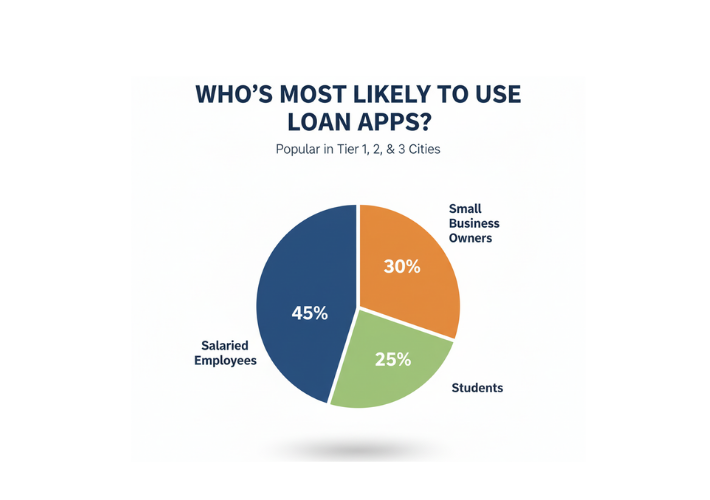

Digital Lending in India 2025 – A Look at the Diverse User Base

The digital loan market in India is growing very fast. In 2025, more than 70 million people are using mobile loan apps to get quick and easy money. This big change is happening because more people have smartphones, Aadhaar makes ID checks faster, and many apps give loans quickly with less paperwork. These apps, approved by the RBI, are now used by both city workers and people in small towns and villages.

Most users are salaried employees, followed by small business owners, students, and gig workers like delivery staff and freelancers. Loan apps are also becoming popular in 1-tier, tier-2 and tier-3 cities because they now support local languages and ask for fewer documents. These apps are helping many different people get access to credit and are closing the gap between those who have financial help and those who don’t.

Choose Wisely – Pick RBI-Authorized Loan Applications

When choosing a loan app in India, it is very important to make sure the app is registered and approved by the Reserve Bank of India (RBI). RBI-approved apps follow proper rules and protect your money and personal information. Unregistered apps may look attractive but can lead to fraud or high interest charges.

Using a trusted app means:

- Your data is safe and secure

- The loan terms are clear and legal

- The recovery process will follow legal methods

Always check if the lending company is an RBI-registered NBFC (Non-Banking Financial Company) before applying.

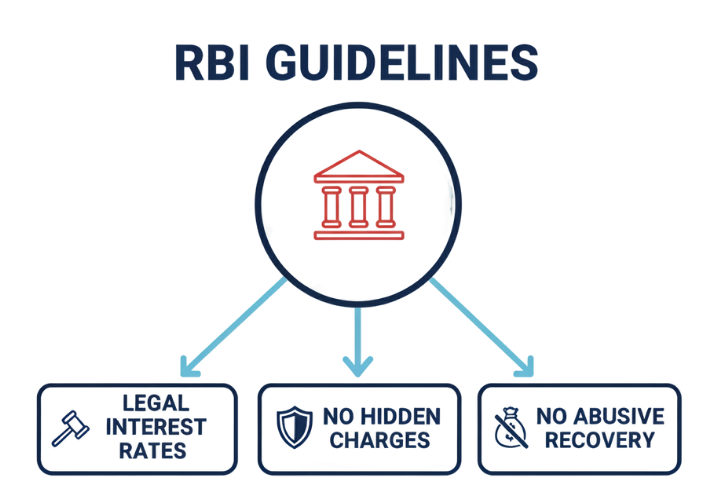

RBI Guidelines and Regulatory Approval

The RBI keeps a list of all registered NBFCs and licensed digital lenders on its website. Many top apps listed above like IDFC First Bank, Bajaj Finserv, KreditBee, Fibe, and others work in partnership with RBI regulated NBFCs.

When an app is RBI complaint, you can trust that:

- Interest rates are within legal limits

- No hidden or illegal charges are applied

- Loan recovery will not include threats or abuse

You can find the RBI’s official list of licensed NBFCs on the RBI website.

Best Practices for Using Best Loan App in India

Taking a loan is a big responsibility. Before using any app, make sure you follow some simple but important practices to avoid problems later.

1. Understand Loan Terms

Always read the terms and conditions before accepting a loan:

- Check interest rate, processing fee, and late fee

- Understand the repayment schedule

- Check whether there are any charges for repaying the loan early.

- Look for hidden charges

Even if it’s a small loan, always know what you’re signing up for.

2. Borrow Responsibly

Failing to pay your loan EMI on time can lower your CIBIL score, which may make it difficult to get loans later.

Here are some repayment tips:

- Set reminders or auto debit for EMIs

- Borrow only what you can repay comfortably

- Don’t take multiple loans at the same time

- If you can’t repay the loan, reach out to the lender and explain your situation.

Timely repayment helps you build a good credit history, which is helpful for future loans.

3. Avoid Untrusted Apps

The digital lending space is growing fast, and sadly, many fake or unauthorized apps take advantage of borrowers.

Watch out for:

- Apps not listed on Google Play Store or iOS App Store

- Lenders who ask for upfront processing fees before approval

- Apps that demand unnecessary access to your contacts or gallery

- Loan apps with no proper customer support or address

Here’s a quick comparison of the top apps before we dive into details:

| Loan App | Loan Range | Approval Time | Tenure | Best For |

|---|---|---|---|---|

| IDFC First Bank | ₹50,000 – ₹50 Lakhs | Within 24 hours | Up to 60 months | High value personal loans |

| Moneyview | ₹5,000 – ₹5 Lakhs | 24–48 hours | Up to 60 months | Low doc, mid-income users |

| Bajaj Finserv | ₹20,000 – ₹25 Lakhs | Within 24 hours | 12 to 60 months | Salaried/self-employed users |

| Olyv | ₹1,000 – ₹2 Lakhs | Instant | 2–12 months | Small ticket loans |

| Buddy Loan | ₹10,000 – ₹15 Lakhs | 48–72 hours | Varies by lender | Comparing multiple offers |

| KreditBee | ₹1,000 – ₹4 Lakhs | Instant | 3–24 months | Students & first-job holders |

| Fibe | ₹8,000 – ₹5 Lakhs | Within 10 minutes | 3–24 months | Salary advances |

| LazyPay | ₹1,000 – ₹1 Lakh | Instant | Flexible | BNPL and online shopping |

| CASHe | ₹1,000 – ₹4 Lakhs | Within 24 hours | 90 days to 1 year | Salaried urban professionals |

| mPokket | ₹500 – ₹30,000 | Instant | 1–3 months | College students |

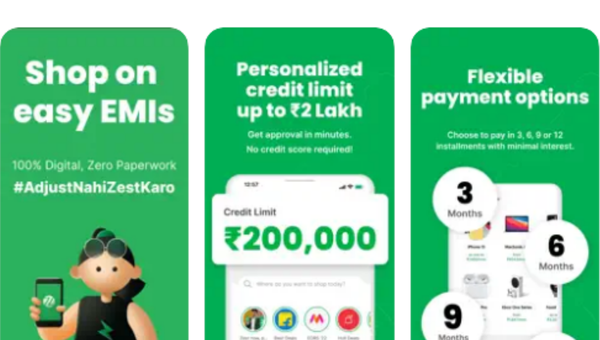

| ZestMoney | ₹1,000 – ₹2 Lakhs | Minutes | Flexible EMIs | Electronics & appliance EMI |

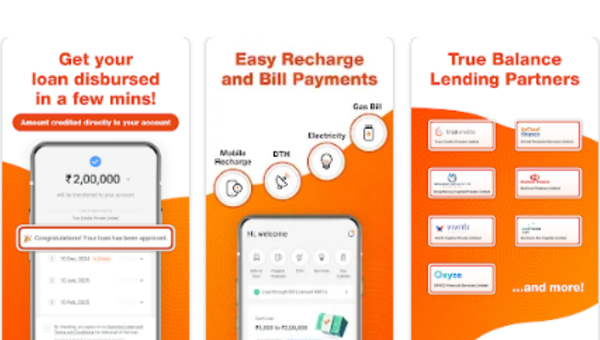

| True Balance | ₹1,000 – ₹50,000 | Quick | Short-term loans | Small cash needs & recharges |

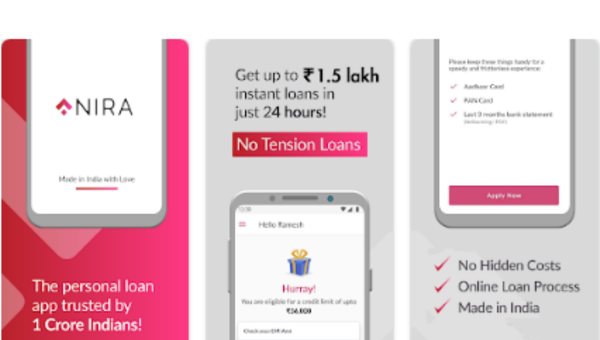

| Nira Finance | ₹5,000 – ₹1 Lakh | Quick | 3–12 months | Salaried professionals |

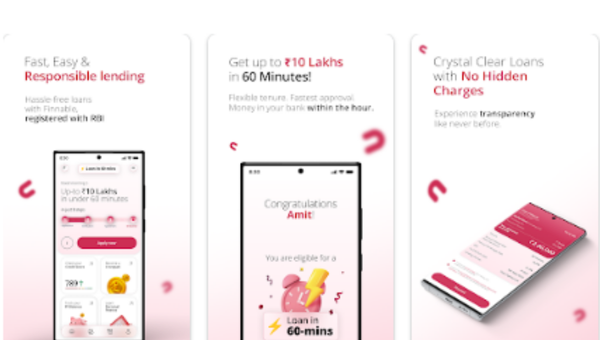

| Finnable | ₹50,000 – ₹10 Lakhs | 24–48 hours | Up to 60 months | Credit-building loans |

| Hero FinCorp | ₹20,000 – ₹10 Lakhs | Quick | Up to 60 months | Loans with trusted brand |

| StashFin | ₹1,000 – ₹5 Lakhs | Instant | Revolving credit | Line of credit flexibility |

| Dhani | ₹5,000 – ₹5 Lakhs | Instant | Flexible tenure | Finance + healthcare |

| LoanTap | ₹25,000 – ₹10 Lakhs | 24 hours | Custom plans | Niche loans like bike/rent EMI |

| PaySense | ₹5,000 – ₹5 Lakhs | 2 days | Up to 60 months | EMI-friendly credit |

| Freo Money | ₹10,000 – ₹5 Lakhs | Instant | Credit line | On-demand borrowing |

Top 20 Best Loan Apps in India – 2025

List of Top 20 Best Loan Apps in India

- IDFC First Bank

- Moneyview

- Bajaj Finserv

- Olyv

- Buddy Loan

- KreditBee

- Fibe

- LazyPay

- CASHe

- mPokket

- ZestMoney

- True Balance

- Nira Finance

- Finnable

- Hero FinCorp

- StashFin

- Dhani

- LoanTap

- PaySense

- Freo Money

1. IDFC First Bank – Best Loan App in India

IDFC First Bank is a trusted name in the Indian banking sector offering fully digital personal loans through its mobile app. Known for its transparent processes and competitive rates, the app is ideal for salaried and self employed professionals.

IDFC First Bank is a scheduled commercial bank governed by the Reserve Bank of India (RBI). All loans are disbursed in compliance with RBI guidelines.

Key Features

- Loan Range: ₹50,000 to ₹50,00,000

- Tenure: Up to 60 months

- Interest Rates: Starting from 10.5% per annum

- Approval: Quick processing with minimal documentation

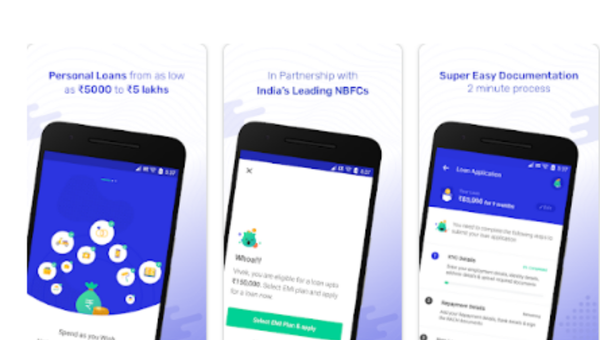

2. Moneyview – Top Leading and Best Loan App in India

Moneyview is a popular lending platform that provides quick and paperless personal loans to salaried and self-employed users across India. With its fast disbursal and eligibility check tools, the app is widely used by borrowers in tier-1 and tier-2 cities.

Moneyview partners with RBI registered NBFCs to ensure fully compliant lending practices.

Key Features

- Loan Range: ₹5,000 to ₹5,00,000

- Tenure: 3 to 60 months

- Interest Rates: Starting at 1.33% per month

- Approval: Disbursal within 24-48 hours

3. Bajaj Finserv

Bajaj Finserv offers pre-approved and instant loans through its mobile app, making it ideal for customers with an existing credit history. The app supports large loan amounts with competitive rates and zero paperwork.

Bajaj Finserv is a licensed NBFC and follows RBI regulations for all personal loan disbursals.

Key Features

- Loan Range: ₹20,000 to ₹25,00,000

- Tenure: Up to 60 months

- Interest Rates: Starting at 11% p.a.

- Approval: Quick, with EMI calculator and document upload features

4. Olyv

Formerly known as SmartCoin, Olyv is a mobile based lending platform focused on India’s underserved segments. It offers accessible and instant personal loans with flexible repayment plans.

Olyv operates in partnership with RBI-registered NBFCs and ensures regulatory compliance for all loan products.

Key Features

- Loan Range: ₹1,000 to ₹2,00,000

- Tenure: 62 days to 12 months

- Interest Rates: 24% to 36% APR

- Approval: Instant approval and disbursal

5. Buddy Loan

Buddy Loan acts as a loan aggregator, helping users compare and apply for loans from multiple RBI approved lenders through a single application.

The platform does not disburse loans directly but connects borrowers to verified partners with flexible repayment options.

Key Features

- Loan Range: ₹10,000 to ₹15,00,000

- Tenure: Varies based on lender

- Interest Rates: From 11.99% p.a.

- Approval: Multiple offers with a single application

6. KreditBee – Top Best Loan App in India

KreditBee is a digital lending platform aimed at young professionals and individuals taking loans for the first time. Through its app, it offers personal loans and consumer durable financing.

The platform partners with RBI registered NBFCs to ensure loans are provided securely and in compliance with regulations.

Key Features

- Loan Range: ₹1,000 to ₹4,00,000

- Tenure: 3 to 24 months

- Interest Rates: Monthly rates starting from 1.02%

- Approval: Approval in 10 minutes with instant KYC

7. Fibe (formerly EarlySalary)

Fibe specializes in short term loans and salary advances for working professionals. It offers flexible products like education loans, travel loans, and medical finance.

Fibe partners with licensed NBFCs and follows RBI lending guidelines strictly.

Key Features

- Loan Range: ₹8,000 to ₹5,00,000

- Tenure: 3 to 24 months

- Interest Rates: Starting from 24% p.a.

- Approval: Instant approval and same-day disbursal

8. LazyPay

LazyPay is a buy now pay later (BNPL) and personal loan platform catering to online shoppers. It offers instant credit and flexible repayment for both low and mid-ticket purchases.

LazyPay works under the credit license of RBI authorized financial partners.

Key Features

- Loan Range: ₹1,000 to ₹1,00,000

- Tenure: Up to 12 months

- Interest Rates: Based on usage and profile

- Approval: One-click credit access for eligible users

9. CASHe – Best Loan App in India

CASHe offers short-term personal loans using an alternate credit scoring system. It’s ideal for salaried millennials and professionals who may not have a strong credit history.

CASHe is partnered with RBI licensed NBFCs and ensures a secure lending process.

Key Features

- Loan Range: ₹1,000 to ₹4,00,000

- Tenure: 3 to 12 months

- Interest Rates: 2.5% to 3% per month

- Approval: Same day approval with PAN and Aadhaar

10. mPokket – Best Loan App in India

mPokket specializes in personal loans for college students and young professionals and is particularly popular among students seeking short term funding.

Loans are issued through partner NBFCs in full compliance with RBI regulations.

Key Features

- Loan Range: ₹500 to ₹30,000

- Tenure: 61 to 90 days

- Interest Rates: Up to 4% monthly

- Approval: Instant with digital KYC

11. ZestMoney

ZestMoney provides no cost EMI financing to users without requiring a credit card. The app enables customers to make purchases from partnered merchants and pay in flexible installments.

ZestMoney works in collaboration with RBI-regulated NBFCs to offer secure and legal digital credit services.

Key Features

- Loan Range: ₹1,000 to ₹2,00,000

- Tenure: 3 to 12 months

- Interest Rates: As low as 0% (with select partners)

- Approval: Instant credit limit based on PAN, mobile, and KYC

12. True Balance

True Balance is a multifunctional financial app offering small-ticket instant loans, bill payments, and mobile recharges. It is especially popular in tier-2 and rural areas for its easy to use interface.

True Balance operates through partnerships with RBI approved financial institutions for all lending services.

Key Features

- Loan Range: ₹1,000 to ₹50,000

- Tenure: 62 to 120 days

- Interest Rates: 2.4% to 3% per month

- Approval: Quick approvals and disbursal within hours

13. Nira Finance

Nira is a best loan app in india that provides fast, hassle free loans to salaried individuals across India. It focuses on promoting financial inclusion by offering small to mid-sized loans to low-income earners.

Loans are disbursed through RBI licensed lending partners, ensuring full regulatory compliance.

Key Features

- Loan Range: ₹5,000 to ₹1,00,000

- Tenure: 3 to 12 months

- Interest Rates: Starting from 1.67% per month

- Approval: Approval in minutes, with bank transfer on same day

14. Finnable – Best Loan App in India

Finnable offers fully digital loans to salaried individuals with simple eligibility checks. It is known for its customer support and EMI flexibility.

Finnable is partnered with RBI registered NBFCs and banks for secure loan disbursals.

Key Features

- Loan Range: ₹50,000 to ₹10,00,000

- Tenure: 6 to 60 months

- Interest Rates: Starting from 10.99% p.a.

- Approval: Disbursal within 48 hours after approval

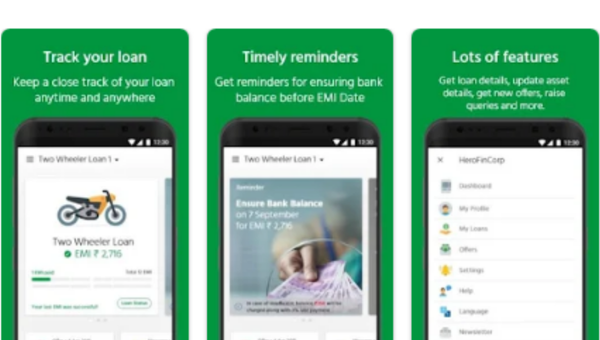

15. Hero FinCorp

Hero FinCorp is a best loan app in india that is a NBFC under the Hero Group, offering personal, auto, and business loan solutions. Their digital loan services are ideal for users looking for large loan amounts with brand backed trust.

Hero FinCorp is an RBI-regulated NBFC offering secure personal loans through its mobile platform.

Key Features

- Loan Range: ₹20,000 to ₹10,00,000

- Tenure: 12 to 60 months

- Interest Rates: Varies based on credit profile

- Approval: Seamless application process with quick verification

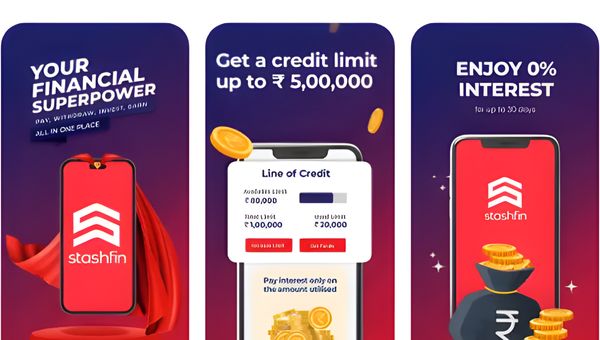

16. StashFin

StashFin is a digital lending platform that provides a revolving line of credit specifically for salaried professionals. It acts as a virtual credit card where you borrow and repay as needed.

StashFin’s services are powered by RBI approved NBFCs ensuring transparent and safe lending.

Key Features

- Loan Range: ₹1,000 to ₹5,00,000

- Tenure: 3 to 36 months

- Interest Rates: Starts from 11.99% p.a.

- Approval: Same day credit limit approval with flexible usage

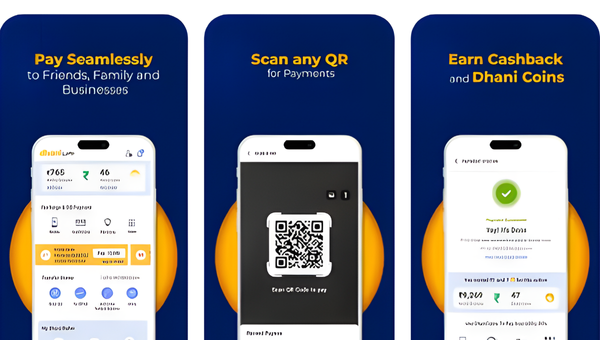

17. Dhani

Dhani blends digital lending with telemedicine and a range of wellness services. It provides instant personal loans and also features Dhani One Freedom, a credit line with 0% interest.

Dhani’s loans are backed by RBI regulated NBFCs and ensure compliance with digital lending standards.

Key Features

- Loan Range: ₹5,000 to ₹5,00,000

- Tenure: Flexible EMIs up to 24 months

- Interest Rates: Zero interest for select plans

- Approval: Instant loan approval with added Dhani Health & Wallet perks.

18. LoanTap

LoanTap focuses on providing customized loan solutions, including EMI free loans, rental deposit loans, and wedding loans. The app allows users to select loan types that suit their specific financial needs.

LoanTap disburses loans via RBI registered lending partners and follows strict verification protocols.

Key Features

- Loan Range: ₹25,000 to ₹10,00,000

- Tenure: 6 to 60 months

- Interest Rates: Starts from 12% p.a.

- Approval: Fast approval within 24 hours

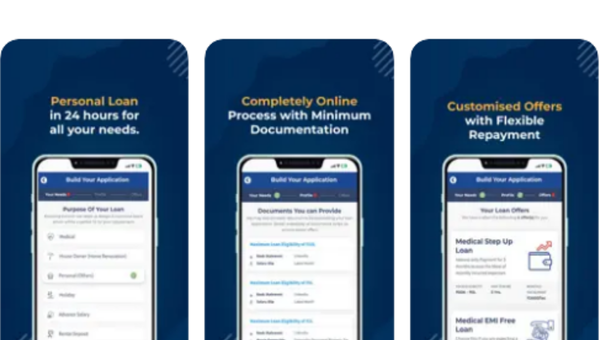

19. PaySense

PaySense provides EMI based personal loans with minimal documentation. It allows salaried and self-employed users to access instant loans up to ₹5 lakhs.

PaySense works in collaboration with multiple RBI approved NBFCs and ensures safe disbursal practices.

Key Features

- Loan Range: ₹5,000 to ₹5,00,000

- Tenure: 3 to 60 months

- Interest Rates: From 1.4% per month

- Approval: Entire process completed digitally in 2–3 days

20. Freo Money

Freo Money offers an on demand digital credit line that works like a revolving loan. It gives users the ability to withdraw small amounts as needed and repay flexibly.

Freo works in partnership with licensed financial institutions to maintain full RBI compliance.

Key Features

- Loan Range: ₹10,000 to ₹5,00,000

- Tenure: Flexible tenure options

- Interest Rates: Pay only on the amount used

- Approval: Instant digital approval with real time credit limit tracking

Step-by-Step Guide To Create Your Own Loan App

Creating your own loan app can be a profitable and impactful business idea. With smartphones becoming common in India, millions of people are looking for quick and convenient ways to get loans. A loan app allows users to apply for personal loans, salary advances, or small emergency loans directly from their phones.

In this guide, we will explain the step-by-step process to create a loan app, from planning to launch, in simple language.

1. Study Your Target Market

The first step in creating a loan app is understanding the market. You need to know who your target audience is, what their needs are, and who your competitors are.

- Identify Your Audience: Are you targeting salaried professionals, students, or small business owners?

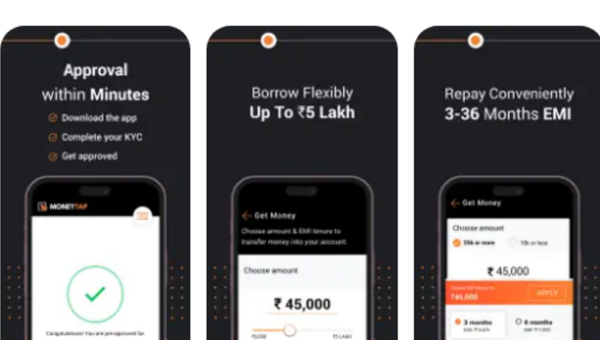

- Analyze Competitors: Study popular apps like PaySense, MoneyTap, and EarlySalary. Understand what features they offer and where they lack.

- Understand User Needs: People want fast approval, minimal paperwork, clear interest rates, and flexible repayment options.

Market research will help you design an app that users actually want.

2. Decide the Type of Loans

Next, you need to decide what kind of loans your app will offer. This will define your app’s features and business model.

- Personal Loans: For emergencies, travel, or personal needs.

- Salary Advance Loans: Loans given before payday.

- Education Loans: Loans for tuition fees, books, or other education expenses.

- Small Emergency Loans: Short-term loans for urgent needs.

You can start with one type of loan and expand later as your app grows.

3. Plan the App Features

A good loan app must have features that make it easy, safe, and fast for users to borrow money. Some essential features include:

- User Registration and Verification – Users should register with their phone number or email. KYC (Know Your Customer) verification using Aadhaar or PAN ensures security.

- Loan Application Form – A simple form that collects user details, income, and loan amount.

- Loan Calculator – Shows users their monthly installment and total payable amount.

- Instant Loan Approval – AI or credit scoring algorithms can approve loans quickly.

- Secure Payment Gateway – Users should repay via UPI, net banking, or wallets.

- Push Notifications – Remind users about repayments, loan approval, or offers.

- Credit Score Display – Helps users understand their creditworthiness.

- Customer Support – Chat, email, or call support for queries.

4. Choose the Technology Stack

To build a loan app, selecting the right technology is important. Your app needs to be fast, secure, and scalable.

- Frontend: React Native or Flutter for mobile apps. These allow your app to run on both Android and iOS.

- Backend: Node.js, Python, or Java to handle app logic, databases, and APIs.

- Database: MySQL, MongoDB, or PostgreSQL for storing user data and loan details.

- Payment Integration: Razorpay, Paytm, or Stripe for repayment systems.

- AI & Credit Scoring: Integrate AI tools to analyze user credit risk.

A skilled development team can help you select the best stack based on your budget and requirements.

5. Partner With Banks or NBFCs

Loan apps need money to lend. You cannot lend your own money at a large scale. That’s why partnering with banks or NBFCs (Non-Banking Financial Companies) is essential.

- Banks or NBFCs provide the funds for loans.

- Your app acts as a digital platform to connect users with lenders.

- Legal agreements ensure compliance with RBI regulations.

Without proper partnerships, your app cannot function legally or safely.

6. Design an Intuitive UI/UX

The user interface (UI) and user experience (UX) are critical for app success. Your app should be easy to navigate, visually appealing, and fast.

- Simple Registration – Avoid long forms; allow OTP login.

- Clear Loan Options – Display loan types, interest rates, and repayment plans clearly.

- Progress Tracking – Users should see their loan status at every stage.

- Error-Free Design – Minimize bugs and crashes.

A smooth UI/UX Design improves user trust and increases downloads.

7. Develop the App

After planning and designing, the next step is app development. This includes both frontend and backend development.

- Frontend Development – Build the user-facing part of the app using React Native or Flutter.

- Backend Development – Develop APIs, database management, and server-side logic.

- Integrate Features – Loan calculator, credit scoring, notifications, and repayment options.

- Security Measures – Implement data encryption, secure login, and fraud detection.

Development may take a few months depending on app complexity.

8. Testing

Testing ensures your app works perfectly before launch. Focus on:

- Functionality Testing – Check all features like registration, loan application, and repayment.

- Performance Testing – App should load quickly and work on different devices.

- Security Testing – Ensure user data is protected from hacking.

- User Testing – Gather feedback from a small group of users and improve the app.

Proper testing reduces crashes and improves user experience.

9. Launch the App

Once testing is complete, it’s time to launch your loan app.

- Google Play Store – For Android users.

- Apple App Store – For iOS users.

- Marketing Campaign – Use social media ads, influencer marketing, and app store optimization to attract users.

A well-planned launch can give your app an initial user base and positive reviews.

10. Post-Launch Support and Updates

Launching is not the end. You must provide ongoing support and updates to keep users happy.

- Bug Fixes – Resolve technical issues quickly.

- Feature Updates – Add new features like EMI reminders or loyalty rewards.

- Customer Support – Ensure users can contact support anytime.

- User Feedback – Collect feedback and improve the app continuously.

Continuous improvement ensures long-term success.

11. Legal and Compliance Considerations

Loan apps operate in a regulated industry. Ensure you:

- Follow RBI Guidelines – Comply with regulations for lending and digital payments.

- Protect User Data – Follow India’s data privacy laws.

- Transparent Policies – Clearly display interest rates, fees, and repayment terms.

- AML & KYC Compliance – Prevent fraud and money laundering by verifying user identity.

Legal compliance builds trust and prevents penalties.

12. Marketing Your Loan App

Marketing is essential to make your app successful. Some strategies include:

- Social Media Marketing – Promote on Facebook, Instagram, and LinkedIn.

- Referral Programs – Encourage users to invite friends and earn rewards.

- App Store Optimization – Use the right keywords and descriptions to rank higher.

- Influencer Marketing – Partner with financial bloggers or YouTubers.

- Digital Ads – Run targeted Google and social media ads for users needing instant loans.

Effective marketing ensures that your app reaches the right audience quickly.

How Much Does It Cost to Build a Loan App in India?

The cost of developing a loan app depends on its complexity, features, and the platforms you choose.

- Basic Loan App: Includes simple features like user registration, KYC verification, loan application, and repayment tracking. If you build it for a single platform (Android or iOS), it can cost around ₹50,000 – ₹1 lakh and take 3-4 months to develop.

- Medium-Level Loan App: Adds features like loan calculator, push notifications, secure payment gateways, AI-based credit scoring, and customer support chat. For Android and iOS, the cost is roughly ₹1 lakh – ₹3 lakh and takes 4-6 months.

- Advanced Loan App: Includes multiple loan types, analytics dashboards for lenders, referral programs, blockchain security, and marketing integration. Developing for Android, iOS, and web may cost ₹3+ lakh and take 6-9 months.

Factors Affecting Cost: Design complexity, technology stack, third-party integrations, and ongoing maintenance.

Thinking of Building an App? Let Team Tweaks Guide You

If you’re planning to build your own mobile app, Team Tweaks is the perfect technology partner to bring your ideas to life. With over 12+ years of experience in the app development industry, we’ve helped startups, enterprises, and global brands create innovative and user friendly digital solutions.

Why Choose Team Tweaks?

Team Tweaks stands out as a leading app development company in Chennai, India for its end to end development approach from strategy and design to deployment and post launch support. Our expert team focuses on innovation, quality, and performance, ensuring your app not only looks great but also performs seamlessly across all platforms. We blend creativity with cutting edge technology to deliver apps that enhance user experience and boost business growth.

Our Services Include:

- Mobile App Development: Custom Android App, iOS App, and Flutter app development solutions.

- Web Development: Scalable and responsive websites tailored to your business goals.

- Digital Marketing: Complete SEO, PPC, and social media marketing support to grow your brand online.

- IoT Solutions: Smart IoT-based apps for real time data and automation.

- Fintech Solutions: Secure, high performance apps for financial operations.

- On-Demand Apps: Ready-made and custom solutions for taxi app like uber, food delivery, handyman app, courier delivery app, and healthcare businesses.

At Team Tweaks, we turn your app vision into a functional, scalable, and market-ready product. Whether you’re a startup or an enterprise, our dedicated team ensures your app stands out in today’s competitive market.

Wrapping Up

Loan apps have made it easier for people in India to borrow money quickly without visiting a bank. In this blog, we shared the top 20 best loan apps in 2025 and explained how to choose and use them the right way. Still, it’s important to borrow money wisely. Always check the interest rate, read the terms and conditions, and make sure the app follows RBI rules. Only borrow if you truly need it and are sure you can pay it back on time.

If you want to build your own loan app, Team Tweaks is the right partner for you. We are one of the best mobile app development company in Chennai India, with over 12+ years of experience in creating secure, easy-to-use, and high quality apps. Our expert team will turn your idea into a trusted and successful loan app. Contact Team Tweaks today and let’s build your app together.